Subscription & SaaS Billing Made Simple

Recurring Revenue, Lower Churn, Cleaner Operations

Moyasar powers subscription billing and usage-based payments using cards and wallets your customers trust. Manage payouts and revenue sharing seamlessly for platforms and partner ecosystems.

Why SaaS Providers Choose Moyasar

Reliable Recurring Billing

Charge customers automatically using saved payment tokens, handling renewals, upgrades, and add-ons effortlessly.

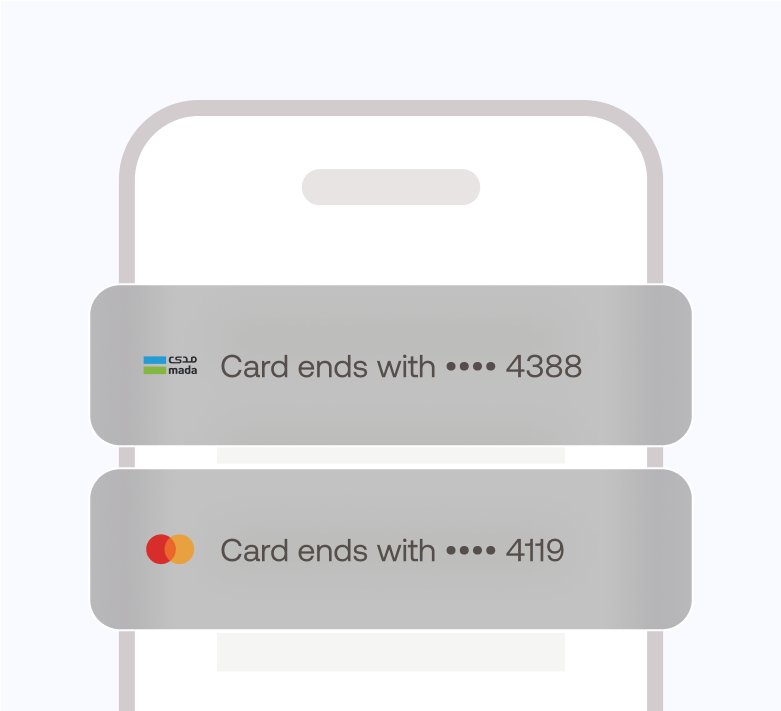

Methods That Convert:

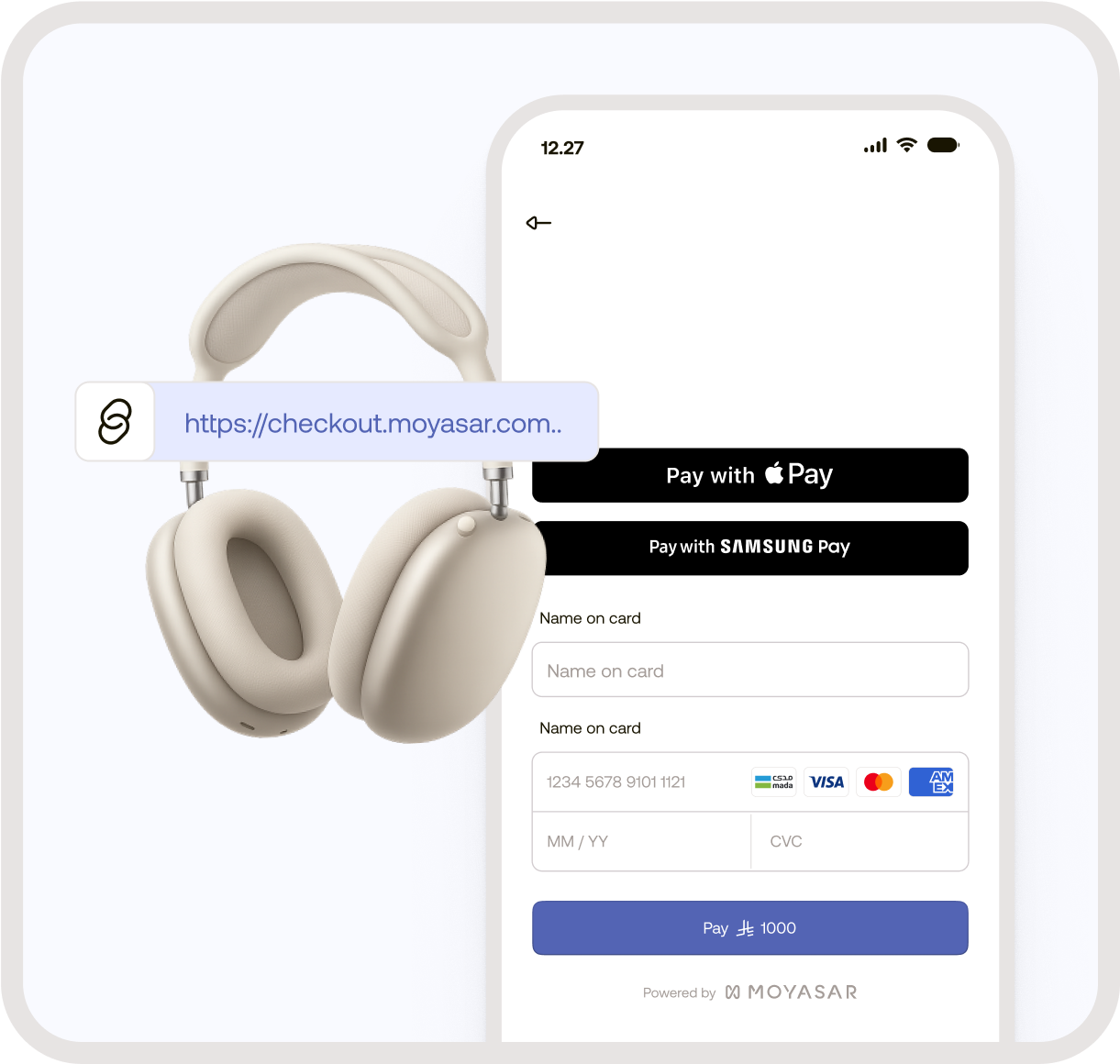

Support popular payment options including Mada, Visa, Mastercard, Apple Pay, and Samsung Pay (subject to approval), maximizing acceptance.

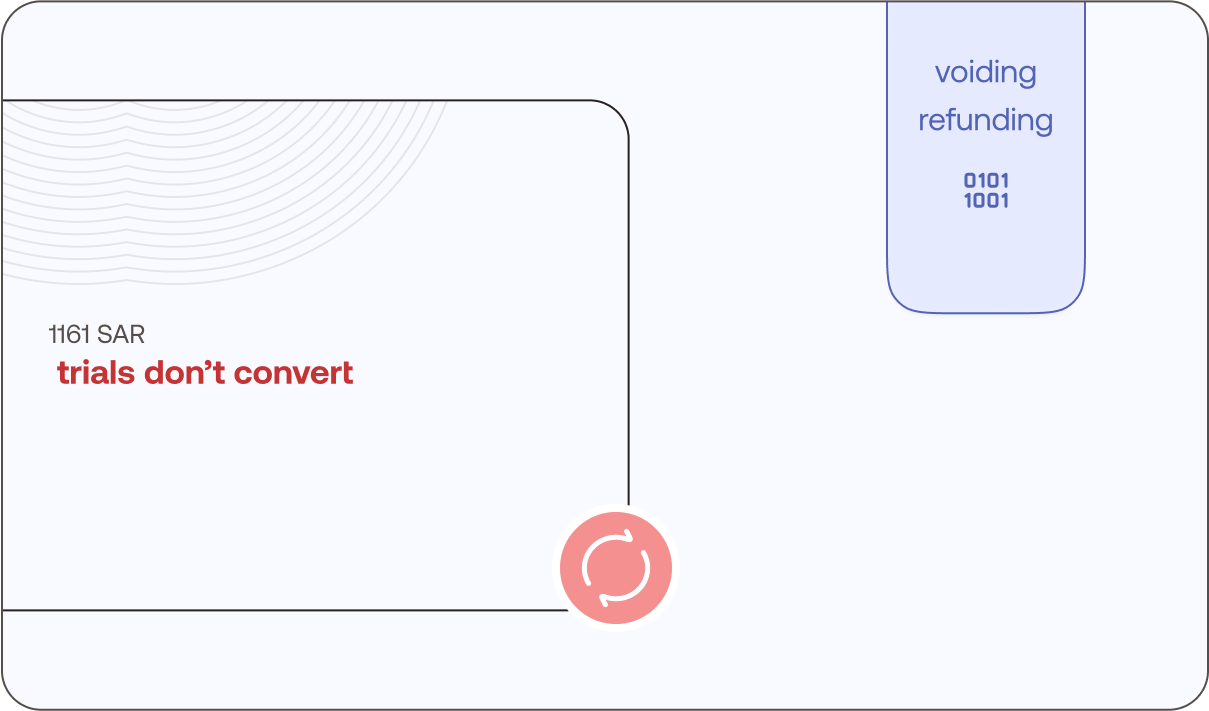

Trials & Post-Delivery Capture:

Authorize payments upfront, capture later—ideal for free trials, onboarding, service activation, or package delivery.

Reduce Involuntary Churn:

Use webhooks for failed renewals, automated dunning (retry logic), and 3-D Secure where applicable.

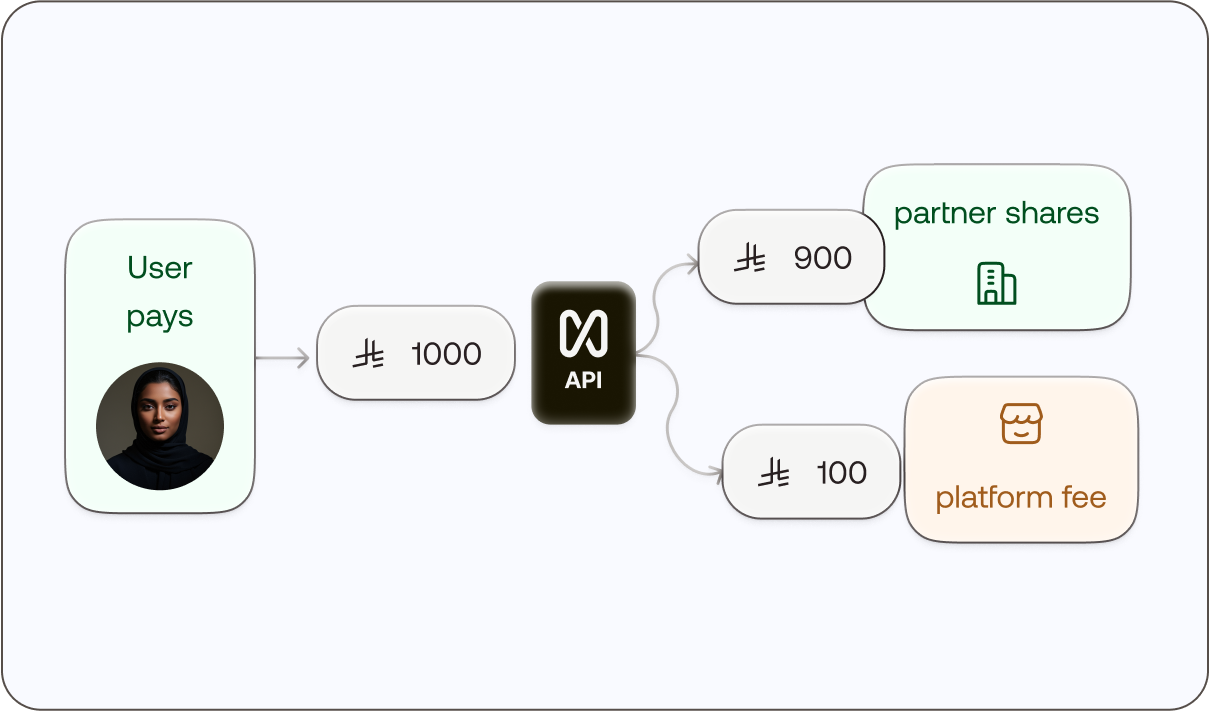

Payouts & Revenue Sharing:

Split payments at checkout or schedule partner payouts with full traceability via Moyasar Payout.

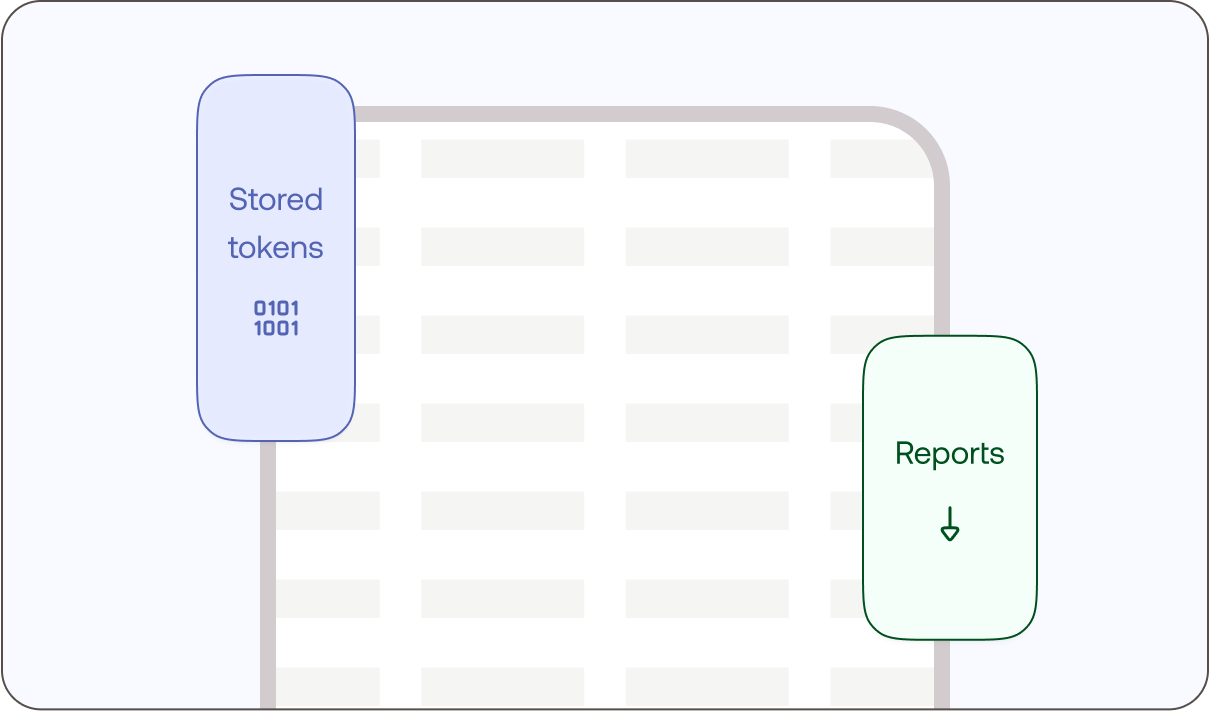

Finance Gets Clarity:

Exportable settlement reports enriched with metadata simplify reconciliation.

Developer Friendly:

Robust REST APIs, webhooks, sandbox environment, and ready-to-use integrations for fast implementation.

What You Can Do with Moyasar

Subscriptions & Recurring Billing

Usage-Based & Hybrid Billing

Trials, Deposits & Post-Activation Capture

Marketplaces & Platforms (SaaS with Partners)

Refunds, Credits & Disputes

Integration options that grow with your business stage

Zero-Code: Payment Links & e-Invoices

Quickly generate payment links or invoices directly from your dashboard—no coding needed, get paid fast.

Low-Code: E-Commerce Plugins

Plug into popular platforms like WooCommerce and OpenCart with minimal setup. Moyasar handles payment status updates via webhooks ensuring smooth transactions.

Developer Flow: Hosted Checkout, SDK, & API

For full control and customization, accept payments via our APIs with support for Mada, Visa, Mastercard, Apple Pay, Samsung Pay, and Google Pay. Leverage our JS payment forms or build your own UI with comprehensive docs. Flutter SDKs enable mobile payment flows with advanced security.

How It Works

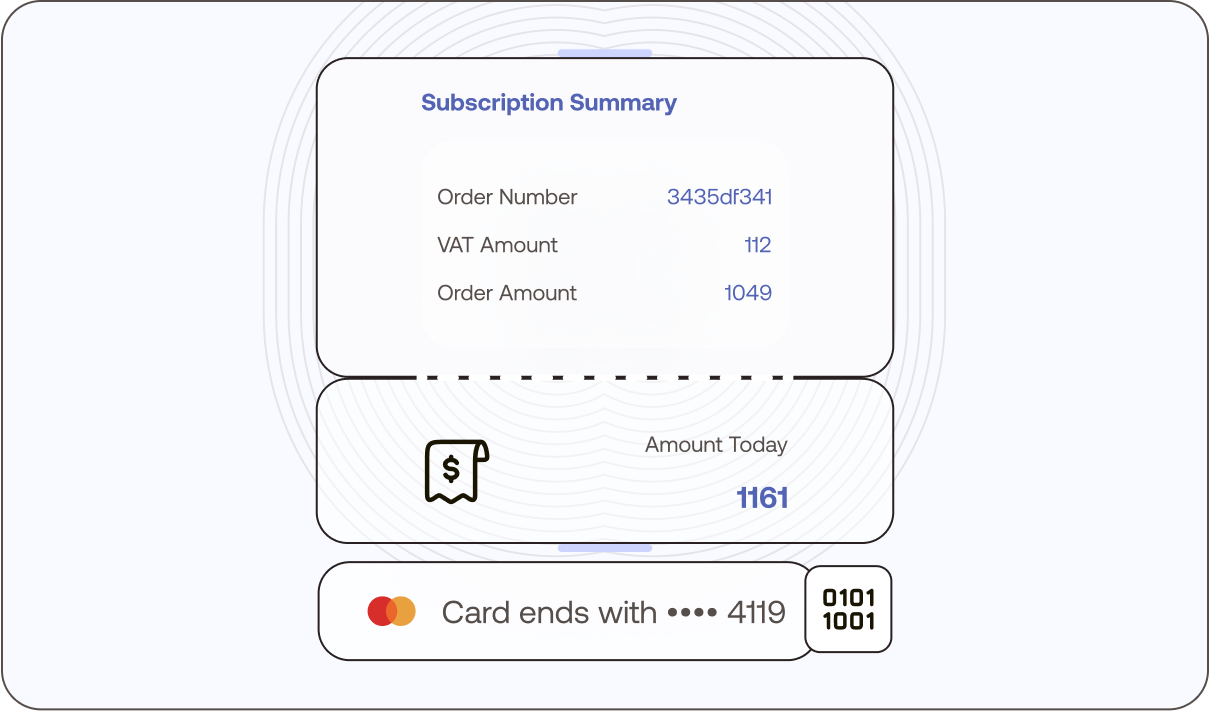

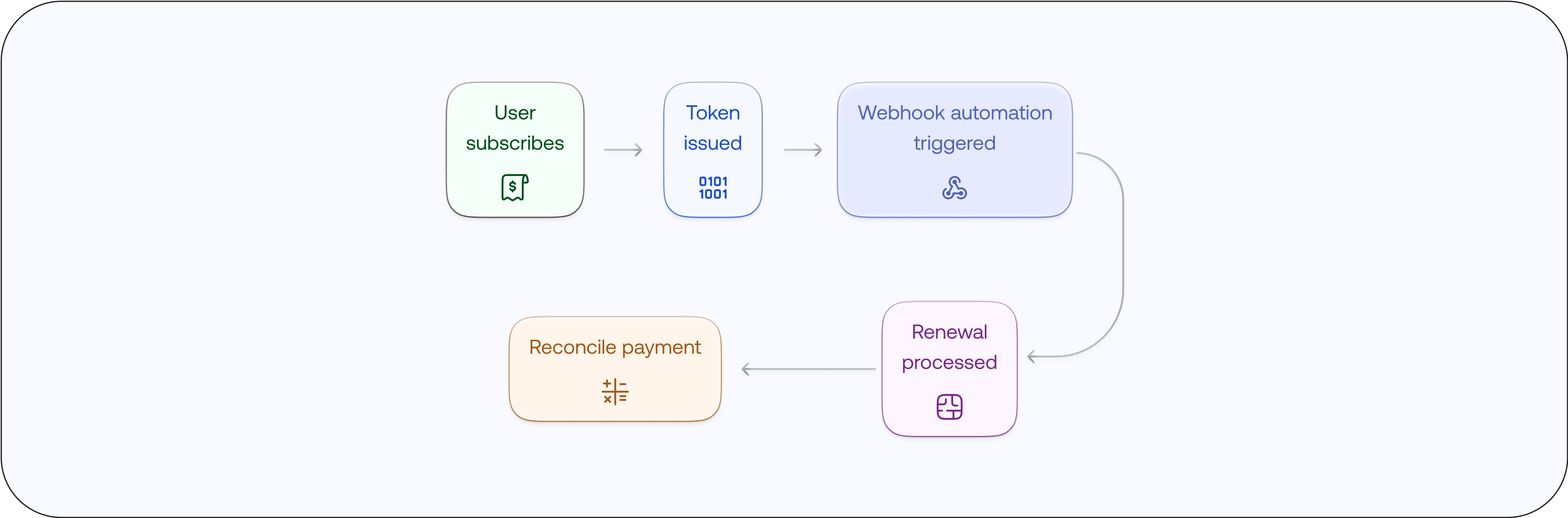

SaaS Subscription Flow with Tokenization

Customer Sign-Up & First Payment

Customer subscribes and pays either the first invoice or a SAR 1 trial charge.

Secure Payment Tokenization

Card/payment details are safely stored as a token for future recurring charges.

Real-Time Webhooks

Your app stays updated as webhooks fire on key events (paid, failed, refund, capture).

Recurring Billing & Dunning

Scheduled charges run automatically; retries handle declines, and payable amounts can be adjusted.

Settlements & Reconciliation

Reports and settlements are delivered on cycle, enabling finance to reconcile and process payments.

Built for Your Teams

Product & Growth

Reduce checkout abandonments with local payment options and wallet support.

Enable trials, upgrades, coupons, and prorations natively using billing engine plus Moyasar APIs.

Finance & Operations

Organize clean statements with optional sub-accounts per product or tenant.

Access detailed settlement reports, audit logs, and dispute timelines in CSV/Excel.

Engineering

Utilize REST APIs with support for idempotency, signed webhooks, and full sandbox testing.

Use Auth/Capture, Refund/Void, metadata, and webhooks to mirror complex billing logic.

Compliance & Security

Adheres to SAMA’s aggregation model with PCI-aligned controls, AML monitoring, and secure tokenization.

Example Use Cases

Powerful payment flows tailored to different industries and business models.

Got questions ?

Learn what Moyasar is, the services it provides, its availability, requirements, and fee structure.

What is Moyasar and what services does it offer?

Moyasar is a fully integrated online payment services that makes accepting payments simple and secure. It supports multiple methods including Mada, Visa, MasterCard, American Express, Apple Pay, Samsung Pay and more.

How do I start with Moyasar?

Go to the Registration Page, fill in the required information, and click Register. A verification email will be sent to you. After creating your account, you can explore features in the sandbox environment. To fully activate your account, fill out the form, and our sales team will contact you shortly.

Can I Activate My Account Before My Website Is Ready?

You need to review the essentials of your store, such as products, images, prices, policies, refund procedures, and communication channels.

Fees & Rates

Fees and rates are provided by our sales team.

What is the invoice service?

It allows you to create a direct payment link through the dashboard and send it to customers via social media or other channels.

How do I register for the Moyasar dashboard?

Go to the registration page, fill in the required details, and verify your email. After account creation, you can explore features in the sandbox. To fully activate the account, fill the activation form and the sales team will contact you.

How long does it take to refund a payment to the customer's card?

Mada cards: 24 hours to 3 business days. Credit cards: 7 to 14 business days. Weekends not included.

Can I activate my account before my website is ready?

Yes, but we need to review your store basics like products, images, pricing, policies, and communication channels.

How secure are payments processed through Moyasar?

Moyasar is PCI-DSS compliant and follows SAMA regulations. All transactions are encrypted and processed through secure channels to ensure maximum security.

What payment methods does Moyasar support?

Moyasar supports Mada, credit cards (Visa, Mastercard, American Express), STC Pay, Apple Pay, Samsung Pay, and other local and international payment methods.

Simplify Recurring Revenue

Streamline Your Subscription Billing

Simplify your recurring payments, reduce churn, and streamline your operations with Moyasar’s trusted platform designed for SaaS providers.

Ready to transform Your Payment Experience?

With Moyasar, your business grows clearly & confidently, start today with a simple step.