Banks & financial institutions

Powering Payments for Banks & Financial Institutions

Moyasar enables banks, digital banks, finance companies, insurers, brokerages, and wallets to accept online payments, automate recurring collections, and disburse funds at scale—all with audit-ready reporting and SAMA-aligned compliance.

What Moyasar Offers to Banks & FIs

Accept trusted payment methods: Mada, Visa, Mastercard, Apple Pay, Samsung Pay

Payment Links & Invoices for no-code collections (via SMS, email, or chat)

Hosted Checkout for quick go-live and a seamless UX

APIs & SDKs for full platform or app control

Manage installments, premiums, and subscriptions with secure tokenization

Authorize now, capture after delivery or verification, & process refunds or voids

Create sub-accounts by product, region, or department

Configure payment methods, fees, and settlement rules per sub-account

Generate settlement reports and API access for each account

Gain full financial clarity with consolidated HQ dashboards & separate statements

Disburse funds to customers, merchants, agents, and partners—on-demand or scheduled

Enable multi-bank B2B support based on your bank’s requirements

Manage beneficiaries with full audit logs and secure file/API operations

Automate payouts such as loan disbursements through the Payout API

Export reports in CSV, Excel, or API with advanced analytics

Track payments, refunds, and auth/capture events in real time with webhooks

Control access with role-based permissions for finance, operations, & support teams

Ensure high availability with SLAs for mission-critical payment flows

Built for Modern Financial institutions

A unified platform for every bank, lender, insurance provider, and financial innovator:

How It Works — Example Workflows

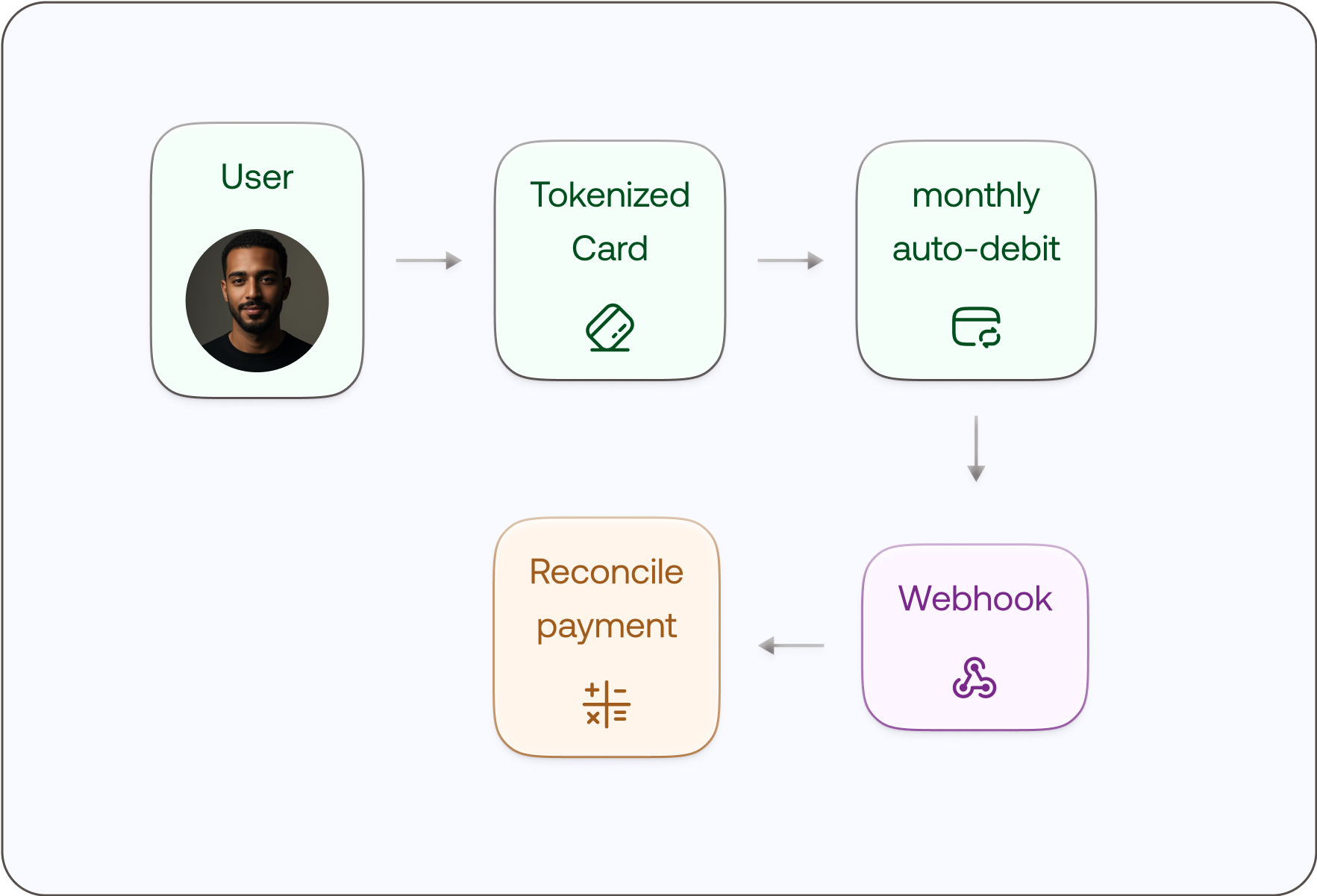

Loan Installment Collection (Recurring)

Customer opts for monthly auto-debit (tokenized card/wallet)

Scheduled charges run automatically; webhooks confirm success or failure

Dunning and automatic retries reduce missed payments

Finance reconciles quickly via detailed settlement reports

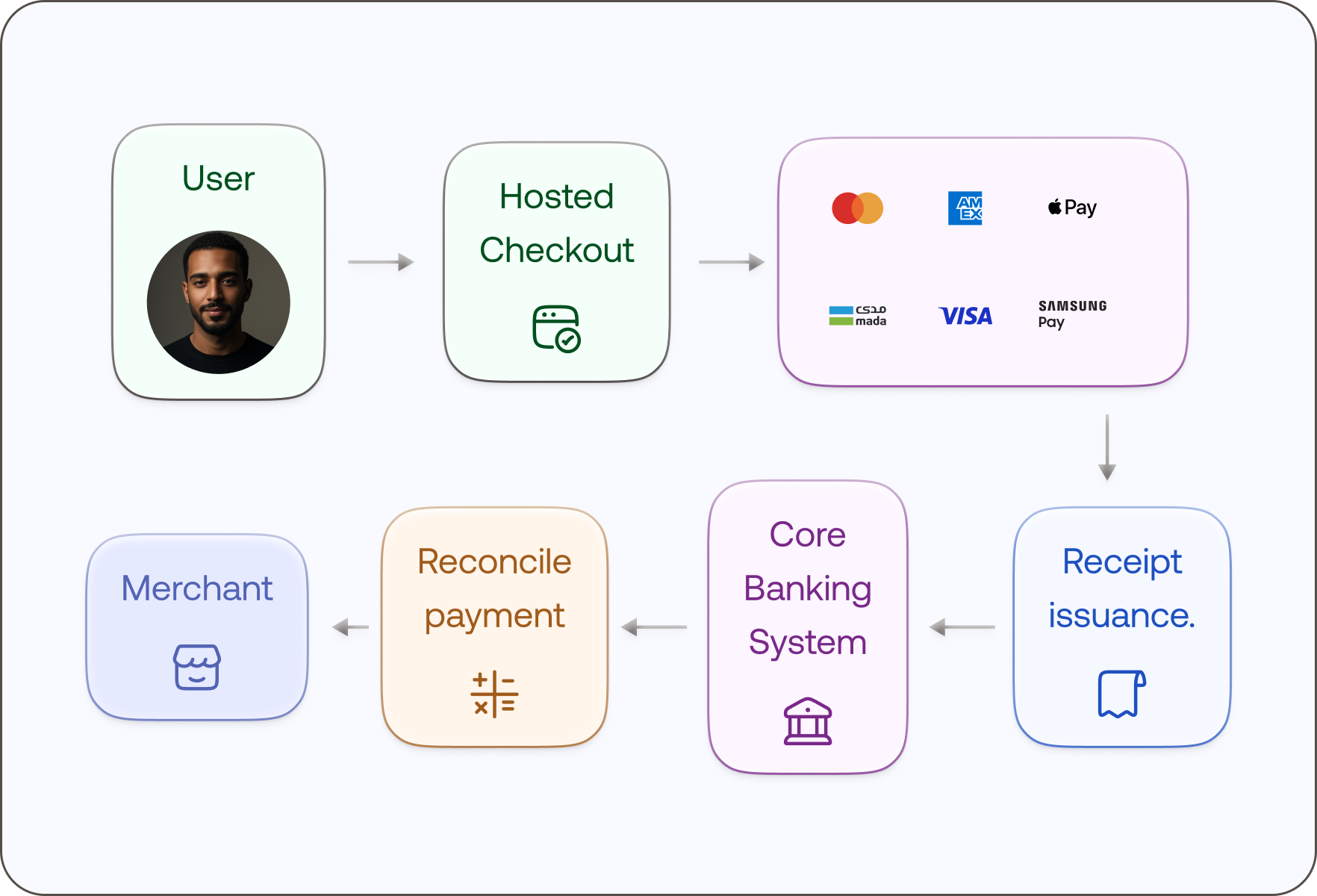

Credit Card Bill / One-off Fees

Customer pays via Hosted Checkout (supports Mada/Apple Pay/cards)

Instant confirmation with receipt issued, core banking updated

End-of-day settlements by product line for simplified finance

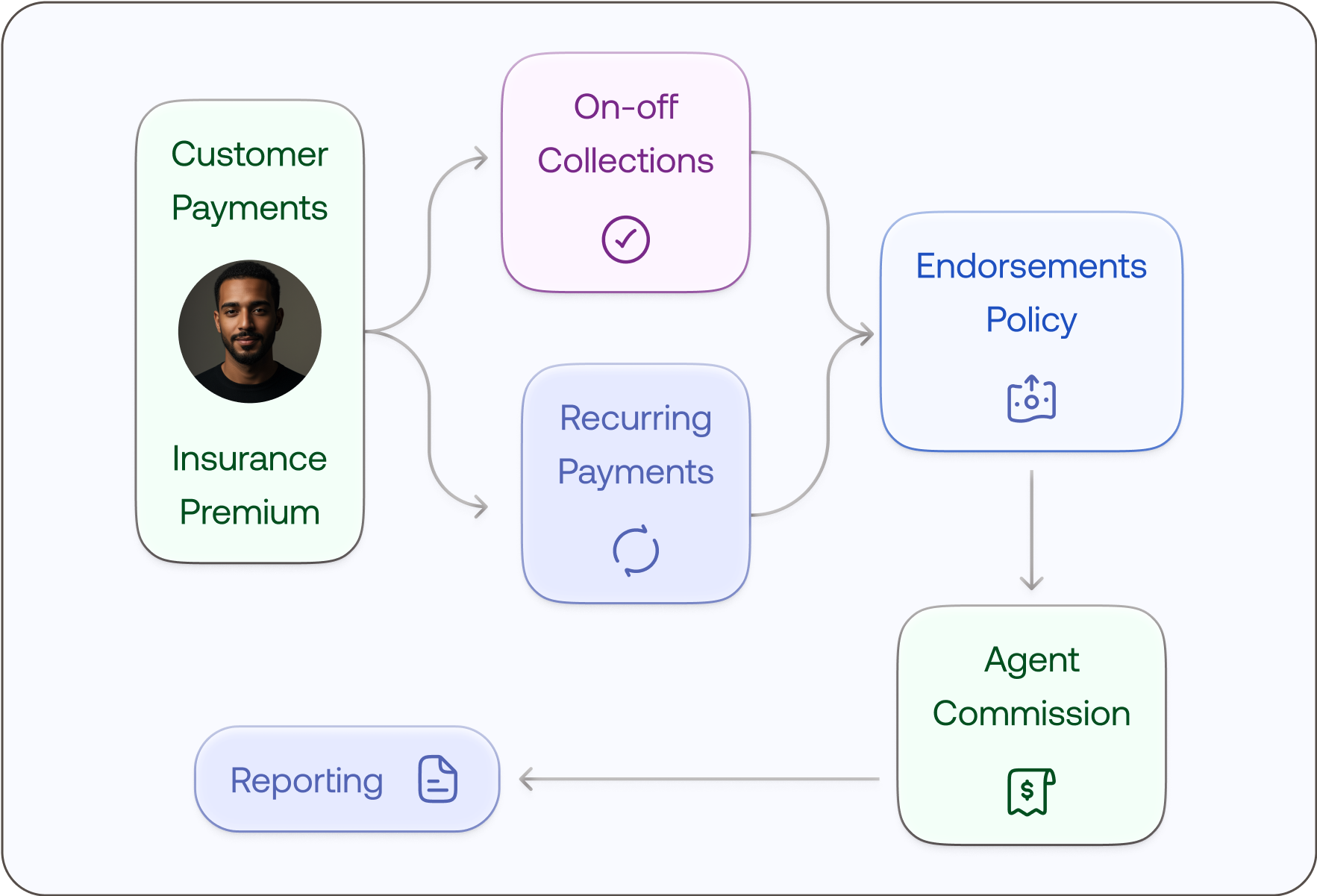

Insurance Premiums, Refunds & Agent Commissions

Premiums collected one-off or recurring

Endorsements trigger partial refunds

Agent commissions paid on schedule via Payouts

Detailed settlement reporting, including insurance ID-based tracking

Metadata for clear identification of every transaction

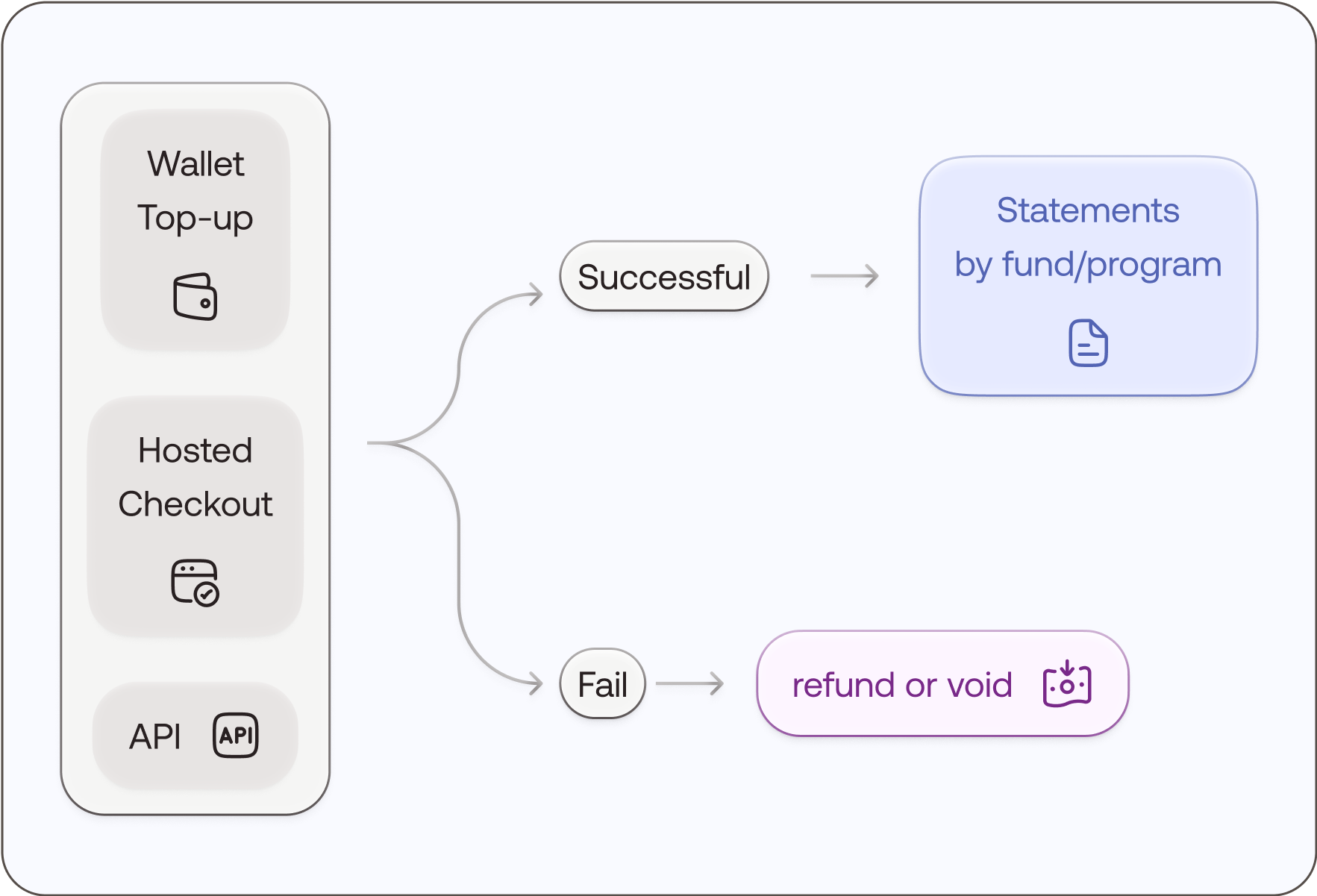

Investment / Brokerage / Capital Management

Investor tops up wallet or pays via Checkout/API

Cancellations/withdrawals processed with refund or void

Statements for finance delivered by fund/program

Apple Pay/Samsung Pay available, with optimized workflow

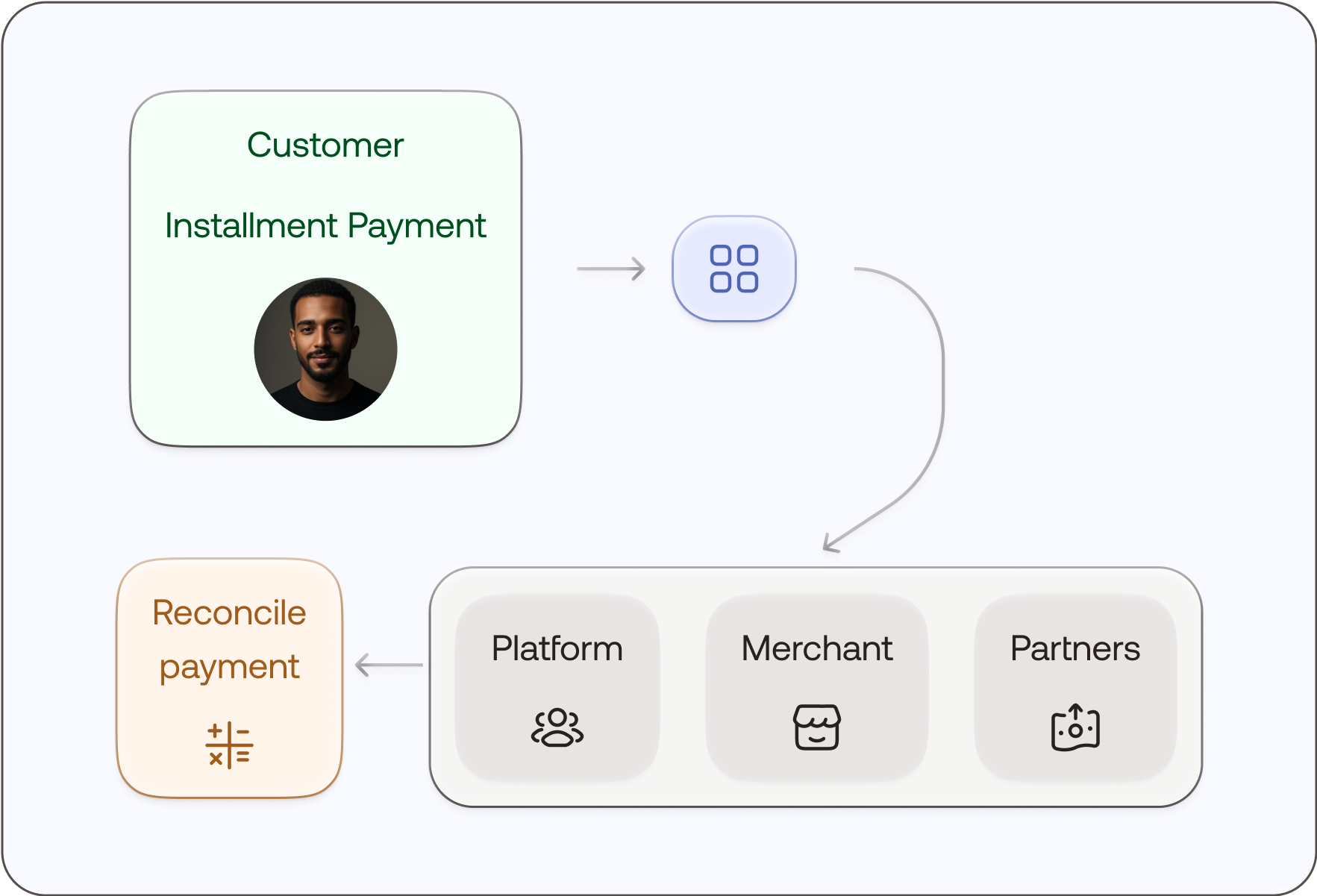

BNPL / Leasing Collections & Merchant Settlements

Installments paid through your portal/app

Platform and merchant splits handled, partner payouts scheduled

Statements available per program or partner for easy reconciliation

Clear payment flow visibility

Why Leading Financial Institutions Choose Moyasar

Built to grow with you—simple, flexible, reliable

Trusted Compliance

SAMA-regulated, PCI-aligned, AML-ready

Comprehensive Reporting

End-to-end clarity for both finance and ops

Rapid Integration

From no-code to enterprise APIs

Always Available

Built for secure, high-volume flows—no downtime tolerance

Got questions ?

Learn what Moyasar is, the services it provides, its availability, requirements, and fee structure.

What is Moyasar and what services does it offer?

Moyasar is a fully integrated online payment services that makes accepting payments simple and secure. It supports multiple methods including Mada, Visa, MasterCard, American Express, Apple Pay, Samsung Pay and more.

How do I start with Moyasar?

Go to the Registration Page, fill in the required information, and click Register. A verification email will be sent to you. After creating your account, you can explore features in the sandbox environment. To fully activate your account, fill out the form, and our sales team will contact you shortly.

Can I Activate My Account Before My Website Is Ready?

You need to review the essentials of your store, such as products, images, prices, policies, refund procedures, and communication channels.

Fees & Rates

Fees and rates are provided by our sales team.

What is the invoice service?

It allows you to create a direct payment link through the dashboard and send it to customers via social media or other channels.

How do I register for the Moyasar dashboard?

Go to the registration page, fill in the required details, and verify your email. After account creation, you can explore features in the sandbox. To fully activate the account, fill the activation form and the sales team will contact you.

How long does it take to refund a payment to the customer's card?

Mada cards: 24 hours to 3 business days. Credit cards: 7 to 14 business days. Weekends not included.

Can I activate my account before my website is ready?

Yes, but we need to review your store basics like products, images, pricing, policies, and communication channels.

How secure are payments processed through Moyasar?

Moyasar is PCI-DSS compliant and follows SAMA regulations. All transactions are encrypted and processed through secure channels to ensure maximum security.

What payment methods does Moyasar support?

Moyasar supports Mada, credit cards (Visa, Mastercard, American Express), STC Pay, Apple Pay, Samsung Pay, and other local and international payment methods.

Automate Financial Operations

Unlock Scalable Payment Solutions

Create your account now and start automating subscriptions with reliable payment methods and full developer control.

Ready to transform Your Payment Experience?

With Moyasar, your business grows clearly & confidently, start today with a simple step.